KiwiSaver

Planning & budgeting

Saving & investing

KiwiSaver

Tackling debt

Protecting wealth

Retirement

Home buying

Life events

Setting goals

Money tracking

Plan your spending with a budget

Getting advice

Studying

Get better with money

What pūtea beliefs do you have?

How to save your money

How to start investing

Find a financial adviser to help you invest

Your investment profile

Compound interest

Net worth

Types of investments

Term deposits

Bonds

Investment funds

Shares

Property investment

How KiwiSaver works and why it's worth joining

How to pick the right KiwiSaver fund

Make the most of KiwiSaver and grow your balance

How KiwiSaver can help you get into your first home

Applying for a KiwiSaver hardship withdrawal

How to use buy now pay later

Before borrowing

How to get out of debt quickly

Credit reports

Know your rights

Pros and cons of debt consolidation

Credit cards

Car loans

Personal loans

Hire purchase

Student loans

Getting a fine

What happens if I start to struggle with moni?

How to protect yourself from fraud and being scammed

About insurance

Insurance types

Insuring ourselves

Wills

Enduring powers of attorney

Family trusts

Insuring our homes

Losing a partner

Redundancy

Serious diagnosis

How to cope with the aftermath of fraud

Separation

About NZ Super

This year's NZ Super rates

When you’re thinking of living in a retirement village

How to plan, save and invest for retirement

Manage your money in retirement

Find housing options in retirement

Planning & budgeting

Saving & investing

KiwiSaver

Tackling debt

Protecting wealth

Retirement

Home buying

KiwiSaver

Budgeting

KiwiSaver

Budgeting

Women

Women

Women

Budgeting

Resources

Help with the cost of living

Just wondering

In need of financial help

Booklets

Glossary

Videos

Blogs

View all

30 March 2015

Reading time: 2 minutes

Posted

by

Tom Hartmann

, 4 Comments

See our guide for the latest rates of NZ Super.

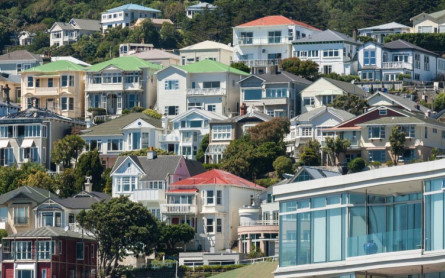

With the NZ Super weekly rate for individuals rising to $375, a question comes to mind: how can anyone pay rent with that amount and still have anything left over for living expenses?

NZ Super seems to do a good job of keeping people out of hardship – if you don’t have high housing costs. And KiwiSaver can help you get on the property ladder sooner and pay off a mortgage well before retirement.

As of this week, the amount of your KiwiSaver savings you can withdraw to buy a first home is increasing.

Now even what we call “the big five hundy” – the $521 you can get from the government each year – can be used. So you can take out all but the $1,000 kick-start that you get when you join.

There's also the KiwiSaver HomeStart grant, which means that, depending how long you’ve contributed to KiwiSaver, the government will give you:

Taking into account housing prices these days, you can use the HomeStart first home buyer's grant for houses that cost up to the following amounts in these areas:

As always, there are conditions for this first home buyer's grant, so for the details try kaingaora.govt.nz/home-ownership/first-home-grant/, email kiwisaver.enquiries@hnzc.co.nz or call 0508 935 266.

The new KiwiSaver first-home withdrawal amounts and HomeStart grants can give you a boost if you’re buying a first home – it’s worth looking into to use them to your advantage.

5 steps to get your $521

1 Comment

Who’s teaching your daughter (or niece, or granddaughter) about money?

1 Comment

My Money Sorted: Hilary Barry

2 Comments

My Money Sorted: Ben

3 Comments

My Money Sorted: Daniel

1 Comment

8 ways to hack Christmas when you’re stretching the budget

6 Comments

Use verification code from your authenticator app. How to use authenticator apps.

Code is invalid. Please try again

Don't have an account? Sign up

Or log in with our social media platforms

A Sorted account gives you a personal dashboard where you can save your tools, track your progress and you'll also receive helpful money tips and guidance straight to your inbox.

Comments (4)

Comments

5 October 23

Julie MM

Can I use my KiwiSaver to buy a new home for me and my family??

4 September 22

Jennifer

By the end of the year, I should be able to buy my first home with the help of my KiwiSaver hopefully.

I am at the moment on a ‘balanced fund’, should I change over to a ‘first time home buyer fund’ now to make it easier to withdraw.

21 August 18

Tom

Thanks for your comment. The cap does not apply to a KiwiSaver withdrawal of your savings. When buying your first home you may be able to make a one-off withdrawal of most of your KiwiSaver savings – as long as you’ve been a contributing KiwiSaver member for at least three years. You also may even qualify if you have owned property previously.

17 August 18

is the cap on house prices only for the homestart grant? or does it apply to withdrawal of saving as well? If you were to only use withdrawal could you get a house for more than your regions cap?

No one has commented on this page yet.

RSS feed for comments on this page | RSS feed for all comments